This toolkit seeks to equip federal and local policymakers with the tools necessary to educate constituents and stakeholders about the climate and clean energy investments in the Inflation Reduction Act and the Infrastructure Investment and Jobs Act. To maximize the opportunities to cut carbon pollution, save consumers money on energy bills, create quality jobs, and expand environmental justice, we all need to be educated about what these investments offer. We are committed to ensuring that families, school districts, businesses, and municipalities have the information they need to access the wide array of clean energy and transportation benefits contained in the affordable clean energy plan.

Content on this page is up-to-date as of August 1, 2024. Check the Google Doc above for additional and new content.

The information on this page is not intended as legal or tax advice for specific individuals or organizations or actual determination of eligibility for tax credits and/or deductions of any particular project or activity. Please visit the IRS website for more information on tax credits and deductions under the Inflation Reduction Act of 2022, and you may choose to consult with a tax advisor.

I. The Affordable Clean Energy Plan:

Investing in Communities to Expand Climate Solutions, Jobs, and Environmental Justice

The Inflation Reduction Act and the Infrastructure Investment and Jobs Act

Taken together, the Inflation Reduction Act (IRA) and Infrastructure Investment and Jobs Act (IIJA) comprise an affordable clean energy plan. This creates a historic opportunity to shape our future by tackling the climate crisis and cutting pollution, rapidly expanding our clean economy, creating good union jobs, and investing in disadvantaged communities.

The affordable clean energy plan investments in the Inflation Reduction Act will help bring the U.S. 80% of the way toward reaching President Biden’s 2030 climate commitments. Further policy actions will take the country across the finish line.1President Biden’s climate action goal has been to reduce our nation’s carbon pollution by at least 50-52% by 2030 and achieve net-zero greenhouse gas emissions by 2050. As the largest clean energy investment America has ever made, the IRA will invest more than $369 billion (perhaps over $570 billion2Estimated Revenue Effects Of Division A, Title III Of H.R. 2811, The “Limit, Save, Grow Act Of 2023”. Joint Committee on Taxation, April 26, 2023. https://www.jct.gov/publications/2023/jcx-7-23/, https://www.cbo.gov/system/files/2023-04/59102-Arrington-Letter_LSG%20Act_4-25-2023.pdf) across the country in solar and wind farms; manufacturing batteries, electric vehicles, and other clean energy components; reducing pollution in environmental justice communities; rebuilding clean industry in places losing fossil fuel jobs; and ensuring the clean energy transition lifts up communities previously left behind while creating millions of family-supporting jobs. It also offers money to help you convert your household to run fully on electricity, backed by clean renewable energy. Programs available now and rolling out soon will help lower the cost of a new or used electric vehicle, install solar panels, and swap out your old, fossil-fueled appliances for new, clean electric alternatives.

You can use the money to modernize your machines: the cars you drive, how you heat the air and water in your home, cook your food, dry your clothes, and get your power. You can also use the money to install additional home energy improvements like solar panels, a home storage battery, and an upgraded electrical panel and wiring. Your neighborhood school, place of worship, or local non-profit could also tap into this financial support to make similar upgrades.

The affordable clean energy plan includes upfront discounts, money back on your taxes, and low-cost financing that you can use over the 10 years to electrify at the pace that works for you. See the specific ways you can benefit from the Inflation Reduction Act’s tax credits and upfront rebates in “Electrifying Your Home or Apartment”.

The affordable clean energy plan also invests in the infrastructure — including roads, bridges, rail, ports, electrical grids, and internet access — that keeps our country running. Specifically, these investments are housed in the Infrastructure Investment and Jobs Act.

Our current systems were constructed decades ago, and the U.S. has fallen behind other developed nations in updating infrastructure for reliability, efficiency, and safety. The Infrastructure Investment and Jobs Act will help modernize our infrastructure, which will lead to massive economic benefits, improvements in public health, and a vital surge in high-quality, family-supporting jobs.

For households across the country, some major benefits people will experience in their daily lives include cleaner water, cleaner air, better buses and trains, faster internet, reliable clean electricity, and improved access to electric vehicle charging. A new Grid Deployment Authority will build a modern and clean electric grid for the 21st century and many school and transit buses on our streets will be upgraded to electric, making important gains in cutting toxic air pollution.

Content on this page is up-to-date as of August 1, 2024. Check the Google Doc above for additional and new content.

The information on this page is not intended as legal or tax advice for specific individuals or organizations or actual determination of eligibility for tax credits and/or deductions of any particular project or activity. Please visit the IRS website for more information on tax credits and deductions under the Inflation Reduction Act of 2022, and you may choose to consult with a tax advisor.

-

Serving and Benefiting Communities

These two federal climate funding initiatives complement one another. The Inflation Reduction Act provides financial incentives to businesses, schools, non-profits, and households to generate clean energy, improve efficiency, and swap out old fossil fuel-based systems, vehicles, and appliances for new, healthier, electric alternatives. The Infrastructure, Investment and Jobs Act provides a huge, and sorely needed, investment to modernize the United States’ infrastructure. Some of the investments in these laws come through grant programs that ensure that federal funding is accessible and prioritizes disadvantaged communities for investment.

Combined, these massive investments are fostering the clean energy transition and building modern, efficient, and reliable infrastructure. These policies will help us generate clean energy to power our homes and transportation systems. Neighborhood by neighborhood, they’ll enable us to modernize our homes and schools, access solar energy, purchase clean, electric appliances, and transition to electric vehicles. The result will be a healthier climate and healthier communities.

See the next section on Justice40 — or J40 for short — an equity-centered effort that ensures funds from federal programs are used to invest in communities that have been historically disinvested in or neglected so that they are not left behind in the U.S. transition from polluting systems to clean electric ones.

The information on this page is not intended as legal or tax advice for specific individuals or organizations or actual determination of eligibility for tax credits and/or deductions of any particular project or activity. Please visit the IRS website for more information on tax credits and deductions under the Inflation Reduction Act of 2022, and you may choose to consult with a tax advisor.

-

Promoting Environmental Justice through the Justice40 Initiative

In January 2021, President Biden issued an executive order titled “Tackling the Climate Crisis at Home and Abroad.” It included several important climate initiatives including Justice40.3The 2021 Executive Order “Tackling the Climate Crisis at Home and Abroad,” also established the White House Office of Domestic Climate Policy, Civilian Climate Corps, and the White House Environmental Justice Advisory Council (WHEJAC).

Justice40 is an initiative where multiple government agencies and departments must work together with states to ensure at least 40 percent of the overall benefits from federal investments are directed to disadvantaged communities.4The working definition of “Disadvantaged Communities” is based on cumulative burden and includes data for 36 burden indicators collected at the census tract level, grouped by fossil fuel dependence, energy burden, environmental and climate hazards, and socio-economic vulnerabilities.

Federal agency programs covered by Justice40 fall into one or more of the following seven investment areas:

- Climate change

- Clean energy and energy efficiency

- Clean transportation

- Affordable and sustainable housing

- Training and workforce development related to the six other Justice40 investment areas

- Remediation and reduction of legacy pollution

- Critical clean water and wastewater infrastructure

The initiative aims to begin addressing high levels of pollution, chronic disinvestment, and lack of access to funds in communities of color and low-income communities. This legacy of inequity has been driven by discriminatory environmental, housing, infrastructure, and economic policies. Learn more about the Justice40 Initiative here. Explore the White House and Council on Environmental Quality’s Climate and Economic Justice Screening Tool here to view census tracts that have been identified as overburdened and underserved.

The information on this page is not intended as legal or tax advice for specific individuals or organizations or actual determination of eligibility for tax credits and/or deductions of any particular project or activity. Please visit the IRS website for more information on tax credits and deductions under the Inflation Reduction Act of 2022, and you may choose to consult with a tax advisor.

-

Jobs & Investment

Since the Inflation Reduction Act was enacted in August of 2022, it has spurred $361 billion in private investments, largely in building clean energy and associated manufacturing, leading to over 312,900 new jobs. As a solar company leader remarked: “We will always look at the history of our industry in two eras now … [before and after] the Inflation Reduction Act.”

The impact is powerful and widespread. These investments and new jobs are being created all around the country, in 41 states — red, blue, purple — and counting. The IRA is projected to create more than 9 million new, family-supporting jobs over the next decade. The U.S. Department of Energy has been tracking these new clean energy jobs. What’s more, these jobs cannot be offshored or outsourced to other countries. We’ll need tens of thousands, if not hundreds of thousands, of new electricians and HVAC (heating, cooling, and ventilation) technicians as well as manufacturing workers in EV, solar, and other clean energy industries. The economic engine of this century is just getting started.

Finally, the affordable clean energy plan is specifically designed to bring manufacturing supply chains back to the U.S., so that our nation receives the economic benefits of creating and delivering products from start to finish. Not only does this help with job security and economic revival but it will help the U.S. achieve energy independence. Reducing our reliance on pricey and unpredictable energy sources like oil and gas means lessening our dependence on anti-democratic forces in rich fossil-fuel exporting countries. As the largest clean energy investment in our history—the plan has put the U.S. back in the (EV) driver’s seat, ready to lead the world in the clean energy transition.

The information on this page is not intended as legal or tax advice for specific individuals or organizations or actual determination of eligibility for tax credits and/or deductions of any particular project or activity. Please visit the IRS website for more information on tax credits and deductions under the Inflation Reduction Act of 2022, and you may choose to consult with a tax advisor.

II. Electrifying Your Home or Apartment

How households can benefit from the affordable clean energy plan investments in the Inflation Reduction Act and the Infrastructure Investment and Jobs Act.

Replacing polluting gas, propane, or fuel oil furnaces with clean, electric heat pumps is the best thing you can do to reduce the climate impact of your home and lower your bills. Heat pumps are three to five times more efficient than furnaces, using heat extraction and compression technology, and don’t burn fossil fuels to create heat. Today’s heat pumps even work well in sub-zero winter temperatures, making them an increasingly popular option in cold climates.

Despite their name, heat pumps don’t just heat – they also cool, meaning you can replace both your gas furnace and existing air conditioner with a single, more efficient, heat pump. In an era of growing heat waves, heat pumps are a great option for those in traditionally milder climates seeking air conditioning for the first time. If you’re adding a heat pump, weatherization upgrades such as adding insulation or sealing windows will allow you to keep your home at a comfortable temperature even more efficiently.

You can also electrify your water heating, your clothes drying, and your cooking, and use the money you’ll get back on your federal taxes—in addition to direct discounts for middle-income families—to lower the cost of making the switch. While older electric stoves also don’t burn fossil fuels inside your home, modern, electric induction stoves are even better, offering quicker heating and more control.

These upgrades to better electric appliances will save on energy costs in most cases. Rewiring America has an incentives calculator that will provide information and resources on state, local, and utility incentives for these home upgrades.

If you don’t know where to start, you might consider getting an energy audit from a building professional who can detail which appliances and energy upgrades can deliver the best long-term savings, comfort, and healthier indoor air (see the section below on the tax credit for home energy audits). If you know which of your appliances are older or failing, look for recommendations for efficient, electric replacements (e.g. heat pumps), and talk to contractors in your area about the smartest way to do the work. Not all contractors are experts in electric appliances, so finding some options and getting a few quotes is a great first step. Rewiring America has a helpful contractor network tool for households: simply enter your zip code and project, and the tool will provide lists of contractors that have been independently qualified by the network.

The information on this page is not intended as legal or tax advice for specific individuals or organizations or actual determination of eligibility for tax credits and/or deductions of any particular project or activity. Please visit the IRS website for more information on tax credits and deductions under the Inflation Reduction Act of 2022, and you may choose to consult with a tax advisor.

-

Accessing Tax Credits to Electrify Your Home

The federal clean energy tax credits work by reducing the money you owe on your federal taxes. Read on to learn how you can receive federal tax credits when you invest in energy efficient home improvements, rooftop solar, a new or used electric vehicle (EV), an EV charger, and more.

- Energy Efficient Home Improvements – up to $3,200 off, each year (25C)

- Section 25C offers a 30% tax credit, up to $1,200 per year for most projects including weatherization and insulation, with a separate $2,000 cap for heat pumps and heat pump water heaters.

- There’s also a $150 tax credit for energy audits.

- Applies to purchases for weatherization projects (insulation, doors, windows) and the purchase and installation of heat pumps, heat pump water heaters, and electrical panel upgrades.

- Available through 2032, with no upper-income limit.

- To claim the credit, fill out IRS Form 5695, Residential Energy Credits. For instructions on how to fill out the form, including more in-depth information about individual amounts you can claim, see the IRS’s Instructions for Form 5695.

- For more information visit the IRS 25C webpage here and the IRS fact sheet here.

- Rooftop Solar and other Clean Energy – 30% off (25D)

- Section 25D offers a 30% uncapped tax credit for rooftop solar installation, solar-powered water heaters, small wind energy, geothermal heating installation, and battery storage installation.

- Available now with no income limit; phases down to 26% in 2033, and 22% in 2034, expires in 2034.

- To claim the credit, fill out IRS Form 5695, Residential Energy Credits. For instructions on how to fill out the form, including more in-depth information about individual amounts you can claim, see the IRS’s Instructions for Form 5695 here.

- For more information visit the IRS fact sheet here.

- New Electric Vehicle – up to $7,500 off (30D)

- Section 30D offers a 30% tax credit of up to $7,500 for new electric vehicles manufactured in the United States.

- Available now on some electric vehicles for households with incomes below $300,000 for joint filers and $150,000 for most other filers.

- As of January 1, 2024, this credit can be transferred to dealerships in exchange for a point-of-sale discount, reducing the amount you pay the dealership at purchase.

- You will still need to fill out and include IRS Form 8936 (including your VIN) to show that you claimed the 30D New EV tax incentive. Submit this form with your federal tax return for the year in which you took ownership of your new EV.

- Detailed information about eligibility (income, critical mineral and battery requirements, and manufacturer-suggested retail price) requirements is available here.

- Here is the list of eligible vehicles.

- Section 30D offers a 30% tax credit of up to $7,500 for new electric vehicles manufactured in the United States.

- Used Electric Vehicle – up to $4,000 off (25E)

- Section 25E offers a 30% tax credit of up to $4,000 for used electric vehicles.

- There are income limits of $150,000 for joint filers and $75,000 for most other filers, and there are manufacturer’s suggested retail price limits but no manufacturing requirements.

- Detailed information about qualified vehicles, income eligibility, and more is available here.

- As of January 1, 2024, this credit can be transferred to dealerships in exchange for a point-of-sale discount, reducing the amount you pay the dealership at purchase.

- You will still need to fill out and include IRS Form 8936 (including your VIN) to show that you claimed the 35E Used EV tax incentive. Submit this form with your federal tax return for the year in which you took ownership of your EV.

- Available now through 2032.

- Section 25E offers a 30% tax credit of up to $4,000 for used electric vehicles.

- EV Charger – 30% up to $1000 off (30C)

- Section 30C offers a 30% tax credit dedicated to low-income or rural areas toward the total purchase and installation of EV charging equipment—up to $1,000 per charger.

- Includes bi-directional chargers.

- Find out if your community qualifies by using the U.S. Department of Energy’s 30C Tax Credit Eligibility Locator.

- To claim the credit, fill out and submit IRS Form 8911 and file it with your income tax return for the year in which your EV charger was purchased.

- Section 30C offers a 30% tax credit dedicated to low-income or rural areas toward the total purchase and installation of EV charging equipment—up to $1,000 per charger.

The information on this page is not intended as legal or tax advice for specific individuals or organizations or actual determination of eligibility for tax credits and/or deductions of any particular project or activity. Please visit the IRS website for more information on tax credits and deductions under the Inflation Reduction Act of 2022, and you may choose to consult with a tax advisor.

- Energy Efficient Home Improvements – up to $3,200 off, each year (25C)

-

Consumer Rebates on Electric Appliances and Energy Efficiency

The IRA also provides funding for states, tribes, and territories to create upfront discount programs on home efficiency upgrades and electric appliances. These two Home Energy Rebates programs are called the Home Efficiency Rebates (HER) and Home Electrification and Appliance (HEAR) programs respectively.

States, territories, and tribal governments have the authority to determine how to utilize rebate program resources. Programs may vary significantly in who is eligible, what projects are covered, what building types are supported, when the rebates are available, and how people can claim rebates. In addition, some states are designing their programs to supplement existing rebates so that households can “stack” benefits, enabling them to make more improvements and capture more cost savings.

Before a state can launch its Inflation Reduction Act Home Energy Rebate Program, it is required to submit an implementation blueprint to the U.S. Department of Energy (territories and tribal governments must do the same). These implementation blueprints must include, among other things, a Community Benefits Plan, Education and Outreach Strategy, and a Consumer Protection Plan. These documents outline specific details around rebate program implementation.

Several states started up these programs in 2024, and many more will launch in 2025. See DOE’s rebate rollout tracker here to see the status of your state program. The Department of Energy Home Energy Rebates fact sheet provides helpful information and resources. Rewiring America’s incentives calculator provides customized information about what benefits you are eligible for and will be continually updated to include states’ rebate program information.

Here is more information about the federal benefits that states will incorporate into their program design:

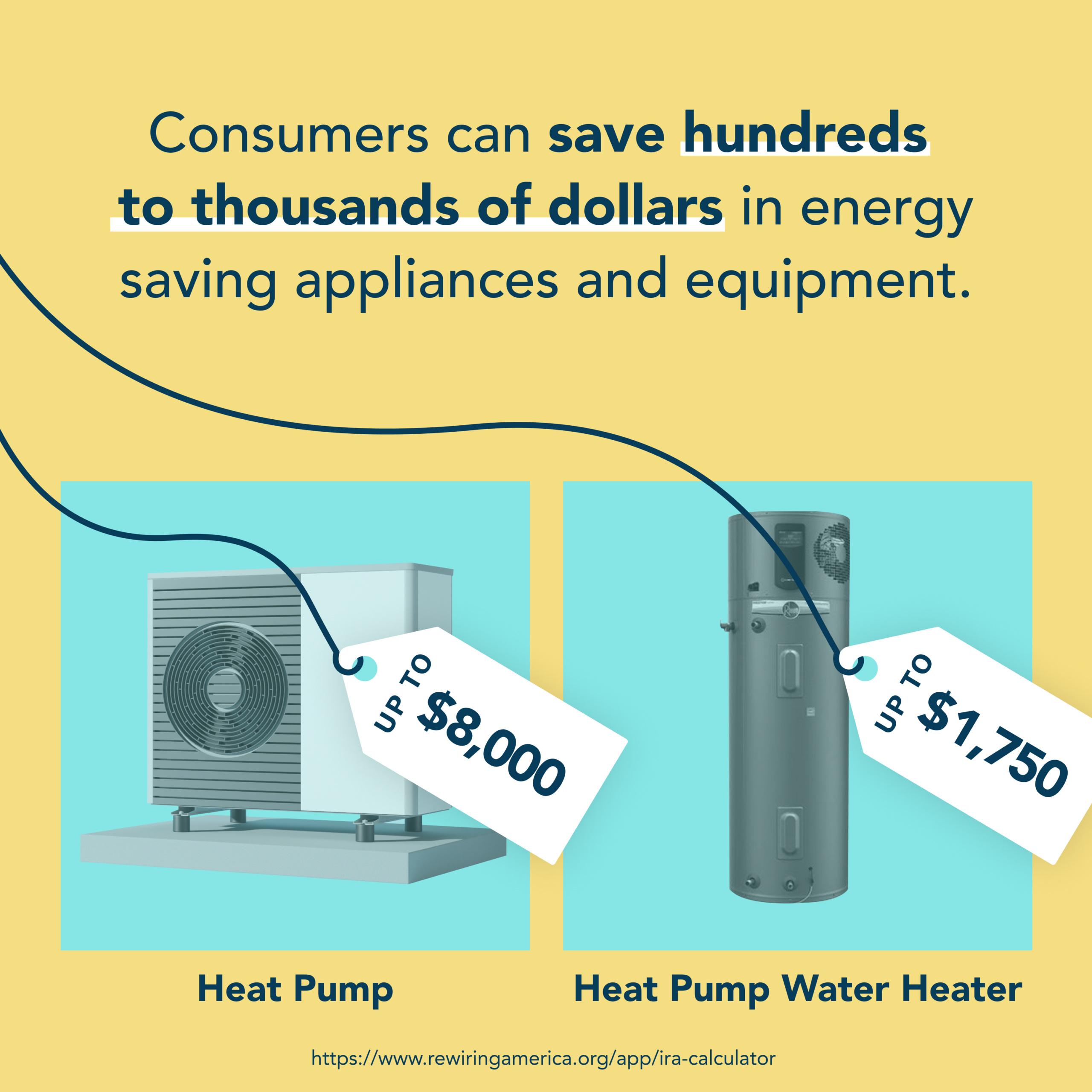

- Electric Appliances — up to $14,000 per household

- $4.5 billion from the IRA is reserved for discounts applied when low and moderate income consumers purchase electric appliances or supporting systems.

- The federal program guidelines set the broadest definition of who might be eligible and what they might be eligible for, which states can further tailor to meet their unique needs. Under those federal guidelines, these rebates can cover up to 100% — up to $14,000 — of the costs for electrification projects for low-income consumers5Defined as earning less than 80 percent of their Area Median Income and 50% for moderate-income consumers.6Defined as earning between 80 and 150 percent of their Area Median Income Within the $14,000 per household limit, individual upgrades are subject to the following caps:

- Heat Pump – $8,000

- Electric Load Service Center – $4,000

- Electric Wiring – $2,500

- Heat Pump Water Heater – $1,750

- Weatherization – $1,600

- Electric/Induction Stove – $840

- Heat Pump Clothes Dryer – $840

- However, each state can decide which residents and which upgrades to apply the rebate funding to. Some states might choose to direct all their rebate funding toward only one of these upgrades (e.g., only heat pump water heaters) or they might choose to include rebate funding for all of these upgrades. Some states may also choose to focus this funding on certain building types, such as affordable multifamily housing or manufactured homes. These more highly tailored, state-specific programs allow the states and territories to strategically deploy this funding in ways that best match the local needs — to fill in gaps or further enhance existing programs, to focus on populations who may have previously been underserved, or to build out fresh approaches tackling greening our homes.

- States are required to ensure that at least 40 percent of the Electric Appliance rebate funding goes toward low-income residents, and an additional 10 percent is reserved for affordable multifamily buildings. Many states have indicated that they plan to go even further, reserving an even larger portion of their funding for low-income residents and affordable multi-family housing. This ensures that these programs will meet the intended goal — to provide assistance to those who need it most, including renters (through their landlords).

- Home Efficiency Improvements – $2,000 to $8,000 per household or more!

- The Efficiency Rebates program sets aside $4.3 billion for energy-efficient upgrades. Homeowners and landlords can work with contractors to access these discounts on whole-home energy efficiency upgrades — adding insulation and air sealing, plus new more efficient appliances. If you’re a renter, this is a great opportunity to let your landlord know how these upgrades could make the property more energy efficient while reducing energy expenses.

- Qualifying for these benefits involves a property owner hiring a contractor to estimate projected energy savings. Higher energy savings will enable even higher rebate levels.

- If the upgrade is modeled to save 35% or more energy you can get up to $4,000 or 50% of project costs, whichever is less.

- If the savings are modeled between 20% and 34%, you can get up to $2,000 or 50% of project costs, whichever is less.

- Measured energy savings allow for uncapped rebates — the more you save over 15% the larger the rebate — and build in accountability for achieving promised savings.

- Low-income households (earning less than 80% of the Area Median Income) receive double incentives, up to 80% of project costs.

- States and territories will be able to tailor these programs to meet their unique needs, including whether to pursue the modeled or measured savings pathway or both, the potential to increase rebate amounts for low-income households, and whether to focus the funding on certain building types like affordable multifamily buildings.

- States are required to ensure that at least 40 percent of the Efficiency Rebates funding goes toward low-income residents, with an additional 10 percent reserved for affordable multifamily buildings. Many states have indicated that they plan to go even further, especially for multifamily housing, bringing crucial benefits to landlords and renters.

Note that you can’t combine Efficiency Rebates with Electrification Rebates for the same upgrade, but you can use both programs for different upgrades in a single project. Learn more about the Home Energy Rebate Programs including all the latest program guidance from DOE here.

The information on this page is not intended as legal or tax advice for specific individuals or organizations or actual determination of eligibility for tax credits and/or deductions of any particular project or activity. Please visit the IRS website for more information on tax credits and deductions under the Inflation Reduction Act of 2022, and you may choose to consult with a tax advisor.

- Electric Appliances — up to $14,000 per household

-

Why These Benefits are Important

The affordable clean energy plan’s investments in our homes and infrastructure can help individuals and families in all zip codes cut down on their energy bills, improve indoor and outdoor air quality, and modernize the technologies we use every day to help curb climate change.

In addition to saving money annually, going fully electric in our homes can shield the economy from energy price spikes and help combat inflation.

The Inflation Reduction Act is a remarkable achievement projected to position the U.S. to reach 80% of our 2030 climate target. The climate provisions of the Infrastructure Investments and Jobs Act will result in additional progress.

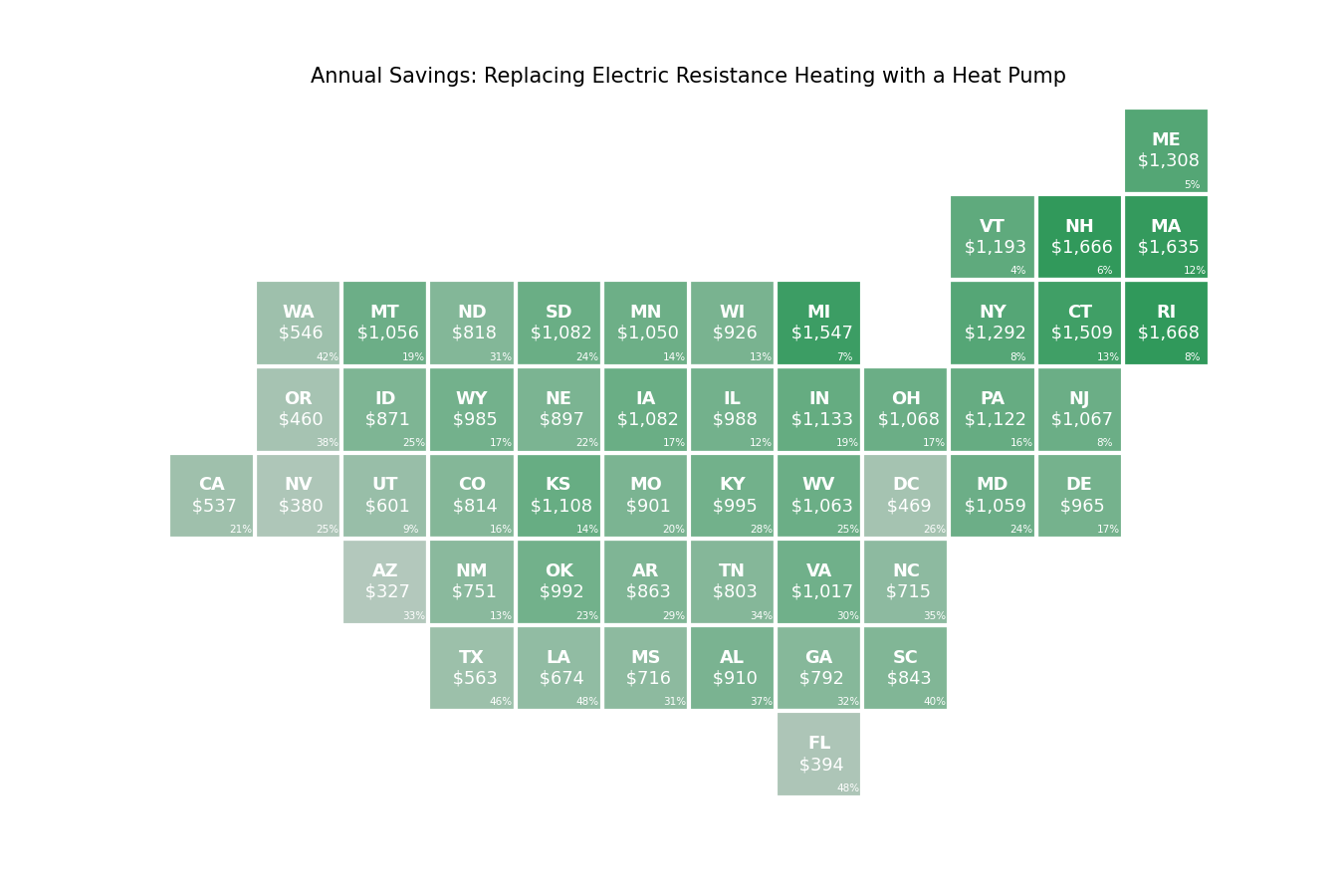

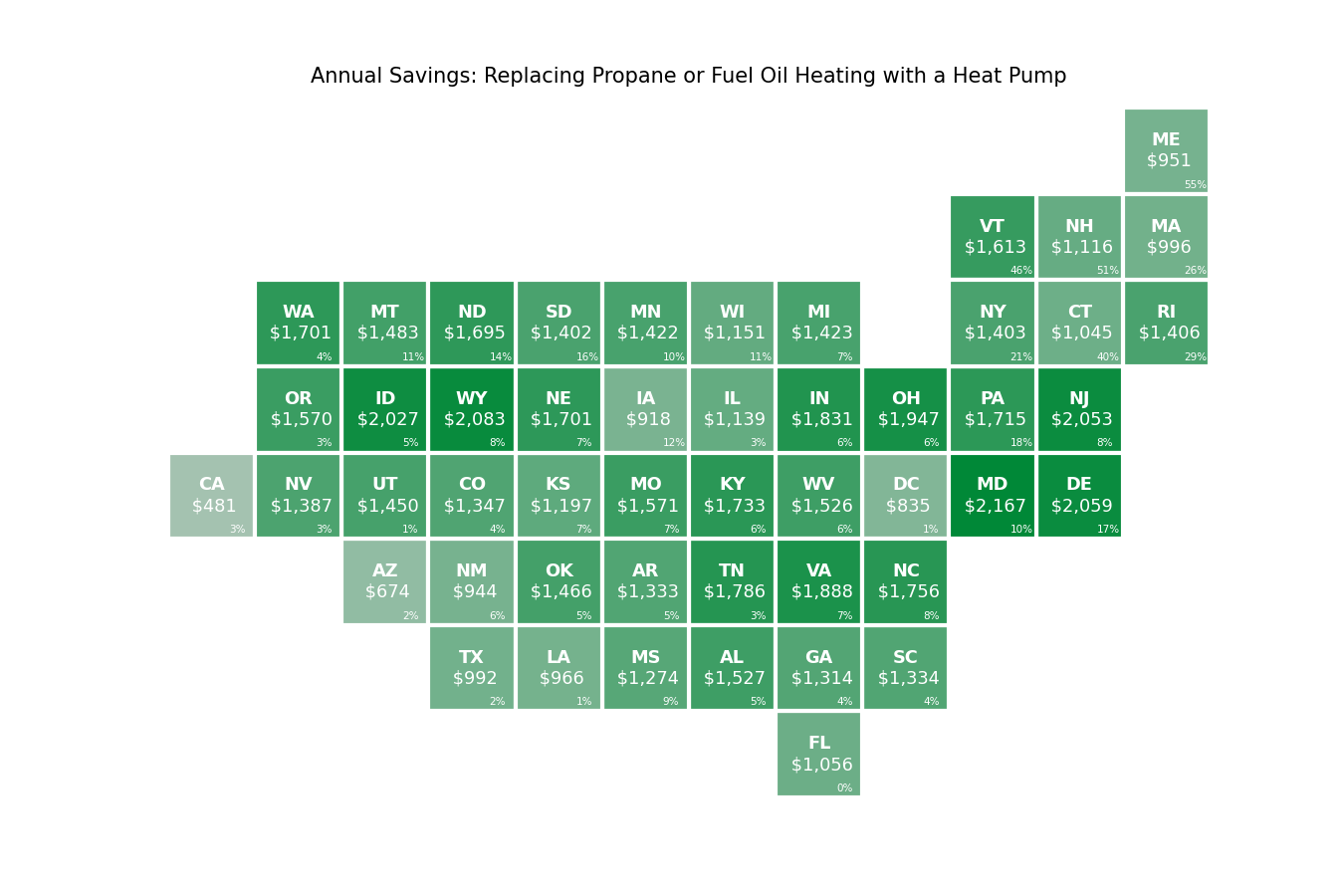

Savings from the Transition to Heat Pumps

Figure 1 shows state-by-state how much the average household would save annually on their utility bills if they switched from electric resistance heating to an electric heat pump. The large number represents the dollar amount of savings and the smaller number at the bottom right corner represents the percentage of the state that uses electric resistance heating, thus, the percentage of the state that could expect this kind of savings.

Figure 2 shows state-by-state how much the average household would save annually on their utility bills if they switched from propane or fuel oil heating (also known as “delivered fuels”) to an electric heat pump. The large number represents the dollar amount of savings and the smaller number at the bottom right corner represents the percentage of the state that uses propane and fuel oil heating, thus, the percentage of the state that could expect these kinds of savings.

The information on this page is not intended as legal or tax advice for specific individuals or organizations or actual determination of eligibility for tax credits and/or deductions of any particular project or activity. Please visit the IRS website for more information on tax credits and deductions under the Inflation Reduction Act of 2022, and you may choose to consult with a tax advisor.

III. Expanding Clean Transportation

In the United States, the transportation sector accounts for 28% of carbon pollution — representing the single largest source of climate-warming emissions in the country. The clean vehicle incentives and programs coupled with the incredible investments in building out the nation’s electric grid and charging infrastructure put us on track to decarbonize our mobility systems, reduce pollution in our communities, and meet our national climate goals.

-

Electric Vehicle Charging Infrastructure

Some of the affordable clean energy plan’s most talked about benefits will save most car-buyers (depending on income) up to $7,500 on the purchase of a new electric vehicle (EV) and up to $4,000 on the purchase of a used electric vehicle. You can also reduce or get money back on your taxes for battery storage systems and dedicated EV chargers that will let you charge your electric vehicle up to 3 times faster than using a standard outlet. (Find out if your community qualifies by using the U.S. Department of Energy’s 30C Tax Credit Eligibility Locator.)

For many people, the switch to electric vehicles has been hindered by no EV charging access or installation opportunities where they live, or unreasonable detours and intense trip planning for long trips or commutes. Fortunately, Congress provided $7 billion of funding for more charging stations nationwide. Through corridor and community charging grant programs, EV charging infrastructure will be available not only along busy highways, but also in places like public parking garages, multifamily buildings and grocery store parking lots, and public parks (updated information here). Ohio, New York, Pennsylvania, and other states have opened their first NEVI-funded charging stations to the public. There are now more than 188,000 public charging ports across the country, with an average of 900 new chargers opening each week.

You may also be able to install an EV charger at your home using the tax incentives (see “Electrifying Your Home or Apartment“), petition your workplace to install faster chargers (called Level 2 or 3 DC fast chargers), and ask your landlord or housing association to provide charging for residents. (These tax incentives are also available for the first time to non-profit groups, tribal and municipal governments, and other entities — see “Schools, Community Centers and Local Government”.)

The information on this page is not intended as legal or tax advice for specific individuals or organizations or actual determination of eligibility for tax credits and/or deductions of any particular project or activity. Please visit the IRS website for more information on tax credits and deductions under the Inflation Reduction Act of 2022, and you may choose to consult with a tax advisor.

-

Public Transportation Investments

The Infrastructure Investment and Jobs Act provided up to $108 billion in much-needed support for public transportation systems across the country. First and foremost, the public transit provisions require that all new projects center investments and create jobs in disadvantaged communities. Specifically, projects that electrify and expand transit services in disadvantaged communities are prioritized for funding. The plan also includes funding for technical assistance and capacity building in these communities. In July 2024, the Biden-Harris administration announced another $1.5B in grants to replace old polluting transit buses with cleaner alternatives, including electric buses, which can also save agencies on the cost of operating the buses while cleaning up communities’ air.

These public transit investments also encourage municipalities to develop affordable housing near new transit facilities — this helps to ensure that communities that have been separated by highways and damaged by redlining (discriminatory practices that increase pollution in disadvantaged communities) can have access to safe, affordable transportation and housing options. In addition to connecting communities, the clean energy initiative provides funds for the development of commuter rail projects. This helps to reduce dependence on vehicles for those traveling to urban areas for work.

Support for public transit in the affordable clean energy plan goes beyond subways and buses – it focuses on micromobility, too. This is the idea that bikes, e-scooters, and pedestrian paths can help to supplement other forms of transportation. Fortunately, the infrastructure law includes $7.2 billion in formula funds to develop micromobility options.

The information on this page is not intended as legal or tax advice for specific individuals or organizations or actual determination of eligibility for tax credits and/or deductions of any particular project or activity. Please visit the IRS website for more information on tax credits and deductions under the Inflation Reduction Act of 2022, and you may choose to consult with a tax advisor.

-

Electric School Buses

The U.S. Environmental Protection Agency’s (EPA) Clean School Bus Program launched in 2022 and will distribute $5 billion over 5 years to replace polluting buses with electric school buses. Propane and compressed natural gas buses are also eligible for some support, but to maximize carbon pollution reduction and reduce exposure to harmful toxins, all-electric buses are best for school children and the communities buses drive through. The program prioritizes funding for low-income, rural, and tribal school districts. The EPA aims to distribute at least $1 billion each year through 2026 in the form of grants and rebates.

Since opening in 2022, the EPA Clean School Bus Program has awarded nearly $3 billion for almost 8,500 new school buses at over 1,000 school districts through three rounds of funding (a mix of upfront rebates and grants). Applicants from 50 states and multiple tribes and territories have submitted nearly $8 billion in funding requests, with the overwhelming majority requesting electric school buses.

The program is expected to open another rebate opportunity in the later part of 2024. Here is more information on EPA’s clean school bus program.

The EPA’s Clean School Bus Program funds can be paired with IRA tax credits newly available to tax-exempt entities like school districts, thanks to a new process called elective payment. Under elective payment, by filing some forms with the IRS, tax-exempt entities that make qualifying investments will receive a check reimbursement or direct payment equal to the value of the tax credit they are claiming. Starting in 2023, school districts can receive up to $40,000 for buying an electric school bus and up to $100,000 for installing its charging station, if the charger is placed in a low-income or non-urban community. These credits are non-competitive and there is no limit on the number of credits that can be claimed.

Together, these federal investments are lowering the total cost of electric school buses and transforming how millions of children get to school.

The information on this page is not intended as legal or tax advice for specific individuals or organizations or actual determination of eligibility for tax credits and/or deductions of any particular project or activity. Please visit the IRS website for more information on tax credits and deductions under the Inflation Reduction Act of 2022, and you may choose to consult with a tax advisor.

IV. Schools, Community Centers and Local Government

How the Affordable Clean Energy Plan Can Benefit Schools, Community Centers, and Local Government

The Inflation Reduction Act introduced and expanded tax credits for a wide array of clean energy technologies, providing unprecedented opportunities over the next decade. In addition to providing incentives to spur private-sector investment, this affordable clean energy plan includes game-changing new provisions that will enable tax-exempt and governmental entities—such as states, local governments, tribes, territories, rural electric cooperatives, and nonprofits including places of worship, to take an active role in building the clean energy economy, lowering costs for working families, and advancing environmental justice.

Thanks to the Inflation Reduction Act’s “direct pay” provisions (also known as “elective pay”), tax-exempt and governmental entities will now be able to receive a payment equal to the full value of tax credits for qualifying clean energy projects. Unlike competitive grant and loan programs in which some applicants may not receive an award, direct pay allows entities to get their payment if they meet the requirements for both direct pay and the underlying tax credit. For more information about using direct pay on projects that are receiving grants and forgivable loans, click here.

Applicable entities can use direct or elective pay for 12 of the clean energy tax credits, including for generating clean electricity through solar, wind, and battery storage projects; building community solar projects that bring clean energy to neighborhood families; installing electric vehicle (EV) charging infrastructure; and purchasing clean vehicles for state, city, or school vehicle fleets. To get started, register with the IRS or check out their FAQ.

-

Opportunities for K-12 Schools and Institutions of Higher Learning

K-12 Schools and colleges and universities are central parts of many communities across the U.S. They are also major consumers of electricity and gas.

For many local governments, K-12 schools represent one of their larger, if not the largest of, budgetary investments. For the first time, school districts can tap into clean energy tax incentives through new direct pay opportunities, as well as other new or expanded grant and loan programs, from the federal clean energy plan. Transitioning school buildings and buses to clean energy enables school districts to save money that they can reinvest in students and classrooms. Many school districts around the country are already embracing this transition. The direct or elective pay opportunities in the Affordable Clean Energy Plan will enable K-12 school districts to speed their clean energy transition.

The same holds true for colleges and universities. Because they are often housed on larger tracts of land, in many cases they are able to generate energy through larger clean energy installations, like solar arrays, in addition to transitioning their buildings and fleets to clean energy. Like K-12 school districts, they stand to benefit a great deal from taking advantage of direct pay opportunities.

K-12 Schools and College Buildings

The affordable clean energy plan provides a lot of new grant support and, for the first time, provides tax incentives to enable school districts and institutions of higher learning to scale renewable energy–including solar and geothermal–to power their buildings and to expand energy efficiency. Cutting the use of fossil fuels to power our nation’s K-12 schools and colleges through investments in rooftop solar, geothermal heat pumps, battery storage and more teaches students about these essential climate solutions in a tangible, hands-on way.

- Energy Efficiency Upgrades – Tax deduction of up to $5 per square foot (179D)

- A tax deduction — which reduces taxable income rather than the taxes owed directly — for large-scale retrofits that verifiably improve a school’s energy efficiency by installing air source heat pumps, LED lighting, heat pump water heaters, and more.

- These deductions range from $0.50 to $5.00 per square foot of floor area.

- The total deduction amount depends on the percentage of energy savings and whether prevailing wages are paid by the contractor.

- Retrofits that reduce energy usage by at least 25% may receive up to $5/square foot.

- These deductions can be transferred from non-taxable entities to retrofit engineers/architects/designers.

- A school can qualify for this deduction every three years if it’s completed at least one qualifying energy-efficient system renovation.

- Available through 2032.

- For more details see official guidance from the IRS here.

- A tax deduction — which reduces taxable income rather than the taxes owed directly — for large-scale retrofits that verifiably improve a school’s energy efficiency by installing air source heat pumps, LED lighting, heat pump water heaters, and more.

- Clean Energy – Tax credit up to $33 per MWh (45)

- The Production Tax Credit (PTC), a tax credit for clean energy production like solar energy, is now available to schools through direct payments.

- The dollar amount of tax credits depends on the amount of energy produced by the facility.

- A K-12 school or institution of higher learning that installs solar is eligible to receive $27.50 per MWh produced, adjusted for inflation, for the first 10 years of production.

- A K-12 school or institution of higher learning must file annually for the credit (more info available on the IRS page above).

- There are bonuses available for projects located in energy communities or utilizing American-made products.

- These bonuses cannot be claimed in conjunction with the Investment Tax Credit.

- This credit is available at least through 2033 and will begin to ramp down after that.

- Clean Energy Investment Tax Credit up to 70% of installation costs (48)

- The Investment Tax Credit (ITC) offers a 30% tax credit off the qualified costs of renewable energy products and is now available to K-12 schools or institutions of higher learning under direct or elective pay.

- Eligible projects include solar PV, geothermal heating, battery storage, and more.

- Bonus credits are available for projects using American-made products or serving low-income and underserved communities or energy communities, potentially increasing the value of the credit to 70% of the eligible installation costs.

- Cannot be claimed in conjunction with the Production Tax Credit.

- This credit is available at least through 2033 and will begin to ramp down after that.

School Buses and Related Infrastructure

Diesel school buses pollute the air in neighborhoods and harm the lungs of millions of school children riding to and from school, affecting their attendance and school performance. Diesel and engine maintenance pose significant costs to school districts and school bus operators. The federal clean energy plan provides a variety of new and expanded tax incentives and grants to local and tribal governments that encourage the transition to zero-emissions school buses. This will help improve air quality for students riding buses, and enable schools to reap the financial benefits of electric school buses, which are cheaper to operate and maintain over their lifetimes. Electric school buses can also be integrated into local grids to assist utilities in providing energy storage and quick response electricity capacity when the buses are not being used to transport students.

- Commercial Clean Vehicle – Tax Credit up to 30% (45W)

- A 30% tax credit on the incremental cost of commercial electric vehicles (or 15% for qualifying plug-in hybrid) placed in service before 2033 (available through direct pay to municipalities and school districts).

- There is a per-vehicle limit of $7,500 for vehicles with a gross weight of fewer than 14,000 pounds (e.g. food service, maintenance, or other district-owned vehicles) and a $40,000 limit for vehicles at or above that weight (e.g. electric school buses).

- See the IRS website for more information.

- EV and Electric School Bus Charging Infrastructure – Property Credit up to 30% (30C)

- A 30% property credit dedicated specifically to low-income or rural areas toward the total purchase and installation of EV charging equipment—up to $100,000 per charging facility.

- Eligible for direct pay.

- Includes bi-directional chargers.

- Find out if your community qualifies by using the U.S. Department of Energy’s 30C Tax Credit Eligibility Locator.

- A 30% property credit dedicated specifically to low-income or rural areas toward the total purchase and installation of EV charging equipment—up to $100,000 per charging facility.

- Clean Heavy-Duty Vehicle – Grant and Rebate Program

- A competitive grant or rebate program to replace dirty heavy-duty vehicles with zero-emission vehicles (ZEV), support ZEV infrastructure, and train workers.

- $1 billion from the Environmental Protection Agency (EPA) to states, local governments, tribes, non-profit school transportation associations, and eligible contractors.

- $400 million allocated toward areas with poor air quality

- This program opened a $932 million grant opportunity in April of 2024. Approximately 70% of this allocation is reserved for electric school buses.

- See the EPA website for more information.

- EPA Clean School Bus – Rebates and Grants

- Rebates and grants are available from 2022-2026 to replace existing school buses with zero-emission and low-emission models.

- $5 billion from the EPA to state and local governmental entities that provide bus service (including school districts), eligible contractors, nonprofit school transportation associations, and tribes responsible for the purchase of school buses or providing school bus services.

- More details on eligibility are available here.

The information on this page is not intended as legal or tax advice for specific individuals or organizations or actual determination of eligibility for tax credits and/or deductions of any particular project or activity. Please visit the IRS website for more information on tax credits and deductions under the Inflation Reduction Act of 2022, and you may choose to consult with a tax advisor.

- Energy Efficiency Upgrades – Tax deduction of up to $5 per square foot (179D)

-

Opportunities for Local Governments

State and local governments will play an integral role in ensuring projects that expand access to clean renewable energy take root and deliver cost savings and air pollution reductions to those who most need the help. Not only do local governments have the opportunity to directly receive funding to create renewable energy projects for their residents through initiatives like community solar, but they also have the opportunity to receive grant awards for establishing new efficient building codes to reduce carbon emissions in new construction projects, and to receive funding for air pollution monitoring systems. Municipalities are also going to have the chance to apply for funding to transition to renewable energy and create the much-needed electrical vehicle charging infrastructure we will need as we shift to zero tailpipe emissions cars and trucks. Also, governmental entities will now be able to receive a payment equal to the full value of tax credits for qualifying clean energy projects through “direct pay” provisions (also known as “elective pay”); register here with the IRS.

To ensure that local governments with fewer resources and staffing are informed of elective pay opportunities, the Department of the Treasury has identified 150 Comeback Communities from across the country that are characterized by high poverty and population decline for targeted outreach and education. The Treasury Department is meeting with leaders of these cities to provide essential information about how elective pay resources can benefit their communities.

- Greenhouse Gas Reduction Fund (GGRF)

- Solar for All competition

- A $7 billion competitive grant funding opportunity run by the EPA for up to 60 recipients including states, Tribal governments, municipalities, and nonprofits.

- Aims to expand access to residential and community solar.

- Awardees have been announced!

- See more information here.

- Solar for All competition

- Technical Assistance for the Adoption of Building Energy Codes

- Funds to adopt, implement, and enforce the latest zero energy codes, or equivalent codes and standards. More information is available here.

- $1 billion from the Department of Energy to state and local governments.

- Charging and Refueling Infrastructure Grant Program

- This program invests in deploying more charging and refueling infrastructure along “Alternative Fuel Corridors.”

- $2.5 billion from the Department of Transportation to states and local governments, metropolitan planning organizations, and other public-sector entities.

- Includes a set-aside for Community Grants.

- See more information here.

- Clean Heavy-Duty Vehicle – Grant and Rebate Program

- This is a competitive grant or rebate program to replace dirty heavy-duty vehicles with zero-emission vehicles (ZEV), support ZEV infrastructure, and train workers.

- $1 billion from the Environmental Protection Agency to state and local governments, tribes, non-profit school transportation associations, and eligible contractors.

- $400 million of which is allocated toward areas with poor air quality.

- See the EPA website for more information.

- Qualified Commercial Clean Vehicle – Tax Credit up to $40,000 per bus, available as direct payments to local governments (45W)

- This section offers a 30% tax credit on the incremental cost of electric (or 15% for qualified plug-in hybrid) commercial clean vehicles placed in service before 2033 (available through direct pay to municipal governments).

- There is a per-vehicle limit of $7,500 for vehicles with a gross weight of fewer than 14,000 pounds (e.g. food service, maintenance, or other fleet vehicles) and a $40,000 limit for vehicles at or above that weight (e.g. buses, garbage trucks).

- See the IRS website for more information.

- EV Charging – Tax Credit of up to $100,000 per charging facility, available as direct payments to local governments (30C)

- The EV Charging Tax Credit provides a 30% tax credit (up to $100,000 per charging facility) for electric vehicle charging installed in low-income or rural census tracts.

- Find out if your community qualifies by using the U.S. Department of Energy’s 30C Tax Credit Eligibility Locator.

- Nonprofits and other non-taxable entities can claim the credit via direct pay.

- Available through 2032.

- Environmental and Climate Justice Block Grants

- $3 billion in total funding – $2.8 billion for financial assistance and $200 million for technical assistance from the EPA.

- Climate Pollution Reduction Grants

- These grants will help states and local governments plan and implement programs, policies, measures, and projects that will achieve or facilitate the reduction of climate pollution. Priority Climate Action Plans by state can be found here.

- $5 billion from the Environmental Protection Agency to states, tribes, air pollution control agencies, and municipalities. See more information here.

- $250 million toward the development of plans and grants for one entity in each state and a number of metropolitan statistical areas.

- $4.75 billion competitively awarded for implementation.

- Climate Pollution Reduction Planning Grants awarded to state and local governments expected July or August 2023.

- Clean Energy Investment Tax Credit, available as direct payments to municipalities

- The Investment Tax Credit (ITC, Section 48 or 48E) provides a 30% tax credit (uncapped) on the cost of installing solar, geothermal, energy storage, and more.

- Can be used for utility-scale projects like a municipal-owned community solar development or building-scale projects like rooftop solar on institutional buildings.

- Utility-scale projects must meet labor requirements to claim the full 30% credit.

- Additional bonuses for projects that use domestic content and projects in legacy energy communities or in low-income communities.

- Can be used for utility-scale projects like a municipal-owned community solar development or building-scale projects like rooftop solar on institutional buildings.

- Credit can be claimed directly by non-taxable entities, see IRS guidance for more details, or register with the IRS here.

- The Investment Tax Credit (ITC, Section 48 or 48E) provides a 30% tax credit (uncapped) on the cost of installing solar, geothermal, energy storage, and more.

- Clean Electricity Production Tax Credit – up to $33 per MWh

- The Production Tax Credit (PTC, Section 45 or 45Y) is for the first 10 years of renewable energy generation for utility-scale or distributed (e.g. rooftop solar) projects.

- Eligible technologies include geothermal electric, solar, wind, hydroelectric, offshore wind, and more.

- For projects < 1MW or meeting labor requirements, the credit is $27.50/MW, inflation-adjusted.

- The base credit of $5.50/MW is multiplied by 5 for projects meeting prevailing wage and registered apprenticeship requirements.

- Credit is increased by 10% if the project meets certain domestic content requirements for steel, iron, and manufactured products.

- Credit is increased by 10% if located in an energy community.

- Cannot be claimed in conjunction with the Investment Tax Credit.

- This credit is available at least through 2033 and will begin to ramp down after that.

- Energy Efficiency Upgrades – Tax deduction of up to $5 per square foot (179D)

- The Commercial Buildings Deduction (179D) allows building owners to receive a tax deduction for installing approved efficient systems for interior lighting, HVAC and hot water systems, or building envelopes.

- Deductions range from $0.50 to $5.00 per square foot of floor area. The deduction amount depends on the percentage of energy savings and whether prevailing wages are paid by the contractor.

- Tax deduction for retrofits that reduce energy usage or costs by at least 25%, up to $5/square foot.7Tax Deductions are an amount that one can subtract from their taxable income to lower the amount of taxes owed.

- The deduction can be transferred from non-taxable entities to retrofit engineers/architects/designers.

- Deductions range from $0.50 to $5.00 per square foot of floor area. The deduction amount depends on the percentage of energy savings and whether prevailing wages are paid by the contractor.

- Available through 2032.

- See IRS guidance here.

- The Commercial Buildings Deduction (179D) allows building owners to receive a tax deduction for installing approved efficient systems for interior lighting, HVAC and hot water systems, or building envelopes.

- Air Pollution Monitoring and Screening Grants

- These grants invest in a range of activities that will increase air monitoring in and by communities.

- $280 million from the EPA to states, local, and tribal governments.

- Closing date varies.

- Grants to Reduce Air Pollution at Ports

- These grants invest $3 billion in competitive rebates and grants to reduce pollution and increase the resiliency of ports.

- Eligible recipients include port authorities, state, regional, local, or tribal agencies with jurisdiction over a port authority or port, air pollution control agencies, or private entities that apply in partnership with an eligible entity and own, operate, or use port facilities.

- $750 million of total funding to be spent in nonattainment areas.

- Funding available until September 30, 2027.

- Green and Resilient Retrofit Program

- This grant and loan program allows affordable apartments to improve energy and water efficiency, reduce climate and air pollution, and increase their resilience.

- Solar power, energy storage, building electrification, energy benchmarking, and technical assistance.

- $1 billion in funding to provide grants and loans — can originate up to $4 billion in loans — for property owners receiving certain types of HUD rental assistance.

- The application deadlines have passed; see here for a list of awardees.

- This grant and loan program allows affordable apartments to improve energy and water efficiency, reduce climate and air pollution, and increase their resilience.

The information on this page is not intended as legal or tax advice for specific individuals or organizations or actual determination of eligibility for tax credits and/or deductions of any particular project or activity. Please visit the IRS website for more information on tax credits and deductions under the Inflation Reduction Act of 2022, and you may choose to consult with a tax advisor.

- Greenhouse Gas Reduction Fund (GGRF)

-

Opportunities for Nonprofits

In many communities across the country, non-profit organizations are the lifeblood of the community and provide needed services. Some of these nonprofits build affordable housing, provide transportation for senior citizens, or assist with job training and placement. Thanks to the provisions in the affordable clean energy plan, for the first time, these organizations are eligible to receive tax credits as direct payments, known as elective or direct pay, so they can better afford to take on needed projects and perhaps even expand or enhance their services. Non-profit groups that build affordable homes can now receive money back for adding solar panels and heat pumps to those homes. Faith-based institutions delivering food to the elderly or homeless can now get money back if they purchase electric vehicles to deliver those meals. By allowing non-profits to apply for grant programs and receive the tax credits as direct payments, they can not only expand their programs but also multiply their effectiveness, all while decreasing overall costs to run their programs while combating the climate crisis and reducing air pollution. Register here with the IRS.

- Greenhouse Gas Reduction Fund (GGRF)

- National Clean Investment Fund

- $14 billion in competitive grant funding for 2-3 national nonprofits partnering with private capital providers.

- The goal is to catalyze tens of thousands of clean technology projects with loans or grants and accelerate progress toward energy independence and net zero carbon pollution.

- Clean Communities Investment Accelerator

- $6 billion in competitive grant funding for 2-7 hub nonprofits working alongside state community development financial institutions to finance clean technology projects and pollution-reducing initiatives.

- Awardees have been announced!

- More information is available here.

- National Clean Investment Fund

- Clean Electricity Investment Tax Credit, available as direct payments to non-profits

- The Investment Tax Credit (Section 48 or 48E) allows a 30% tax credit (uncapped) for solar, geothermal, energy storage, and more.

- Can be used for utility-scale projects like a municipal-owned community solar development or building-scale projects like rooftop solar on institutional buildings.

- Bonuses for projects that use domestic content, projects in legacy energy communities, and projects in low-income communities.

- Credit can be claimed directly by non-taxable entities.

- Full credit available until at least 2033, with a phase-down to follow.

- The Investment Tax Credit (Section 48 or 48E) allows a 30% tax credit (uncapped) for solar, geothermal, energy storage, and more.

- Clean Energy Production Tax Credit – up to $33 per MWh (45)

- The Production Tax Credit (PTC, Section 45 or 45Y) provides a tax credit based on the amount of energy produced for the first 10 years of renewable energy generation at utility-scale or distributed (e.g. rooftop solar) projects.

- Eligible technologies include geothermal electric, solar, wind, hydroelectric, offshore wind, and more.

- For projects < 1MW or meeting labor requirements, the credit is $27.50/MW, inflation-adjusted.

- The base credit of $5.50/MW is multiplied by five for projects meeting prevailing wage and registered apprenticeship requirements.

- Credit is increased by 10% if the project meets certain domestic content requirements for steel, iron, and manufactured products.

- Credit is increased by 10% if located in an energy community.

- Cannot be claimed in conjunction with the Investment Tax Credit.

- This credit is available at least through 2033 and will begin to ramp down after that.

- EV Charging – Tax Credit of up to $100,000, available as direct payments to non-profits (30C)

- The EV Charging Tax Credit in Section 30C allows a 30% tax credit (up to $100,000 per charging facility) for electric vehicle charging installed in low-income or rural census tracts.

- Nonprofits and other non-taxable entities can claim the credit via direct pay. Register here with the IRS.

- Available through 2032.

- Environmental and Climate Justice Block Grants

- Funds for community-led efforts in pollution monitoring, prevention, remediation, and more.

- $3 billion from the Environmental Protection Agency to eligible recipients including:

- 1) a tribal government, local government, OR higher education institution in partnership with a community-based nonprofit

- 2) community-based nonprofit organization

- 3) a partnership of community-based nonprofit organizations

- Grants are awarded for periods of up to 3 years to eligible entities to carry out activities that benefit communities that meet the definition of disadvantaged communities.

- The first of several grants was awarded in early 2023.

- Funding for the Community Change Grants program can be applied for until November 21, 2024. This program is making grant awards on a rolling basis, so applying as soon as possible may be advantageous.

- Energy Efficiency Upgrades – Tax deduction of up to $5 per square foot (179D)

- The Commercial Buildings Deduction (Section 179D) allows building owners to get a tax deduction — which reduces taxable income rather than the taxes owed directly — for installing approved efficient systems for interior lighting, HVAC and hot water systems, or building envelopes.

- Deductions range from $0.50 to $5.00 per square foot of floor area. The deduction amount depends on the percentage of energy savings and whether prevailing wages are paid by the contractor.

- Tax deduction for retrofits that reduce energy usage or costs by at least 25%, up to $5/square foot.

- The deduction can be transferred from non-taxable entities to retrofit engineers/architects/designers.

- Deductions range from $0.50 to $5.00 per square foot of floor area. The deduction amount depends on the percentage of energy savings and whether prevailing wages are paid by the contractor.

- Available through 2032.

- See IRS guidance here.

- The Commercial Buildings Deduction (Section 179D) allows building owners to get a tax deduction — which reduces taxable income rather than the taxes owed directly — for installing approved efficient systems for interior lighting, HVAC and hot water systems, or building envelopes.

- Commercial Clean Vehicle – Tax Credit up to $40,000 per bus, available as direct payments to non-profits (45W)

- A 30% tax credit on the incremental cost of commercial electric vehicles (or 15% for qualified plug-in hybrid) placed in service before 2033 (available through direct pay to nonprofits).

- There is a per-vehicle limit of $7,500 for vehicles with a gross weight of fewer than 14,000 pounds (e.g. food service or maintenance vehicles) and a $40,000 limit for vehicles at or above that weight (e.g. buses).

- See the IRS website for more information.

The information on this page is not intended as legal or tax advice for specific individuals or organizations or actual determination of eligibility for tax credits and/or deductions of any particular project or activity. Please visit the IRS website for more information on tax credits and deductions under the Inflation Reduction Act of 2022, and you may choose to consult with a tax advisor.

- Greenhouse Gas Reduction Fund (GGRF)

V. Businesses

How the Affordable Clean Energy Plan Can Benefit Businesses

A hallmark of American ingenuity involves harnessing our entrepreneurial spirit. Thanks to the Affordable Clean Energy Plan, the opportunities to secure energy independence and encourage up-and-coming entrepreneurs are plentiful. Tax credits that will help establish more efficient buildings and manufacturing processes will not only help reduce carbon emissions but will reduce operational costs for businesses in the country. Additionally, the clean energy incentives create pathways for the United States to onshore and secure the supply chains needed to build out new clean renewable energy infrastructure.

-

Energy Efficiency Upgrades

Energy Efficiency Upgrades – Tax Deduction of up to $5 per square foot (179D)

- The Energy Efficient Commercial Buildings tax deduction (Section 179D) allows building owners to get a tax deduction — which reduces taxable income rather than the taxes owed directly — for installing approved efficient systems for interior lighting, HVAC and hot water systems, or building envelopes.

- Deductions range from $0.50 to $5.00 per square foot of floor area. The deduction amount depends on the percentage of energy savings and whether prevailing wages are paid by the contractor.

- Tax deduction for retrofits that reduce energy usage or costs by at least 25%, up to $5/square foot.

- The deduction can be transferred from non-taxable entities to retrofit engineers/architects/designers.

- Deductions range from $0.50 to $5.00 per square foot of floor area. The deduction amount depends on the percentage of energy savings and whether prevailing wages are paid by the contractor.

- Enhanced credit available through 2032.

The information on this page is not intended as legal or tax advice for specific individuals or organizations or actual determination of eligibility for tax credits and/or deductions of any particular project or activity. Please visit the IRS website for more information on tax credits and deductions under the Inflation Reduction Act of 2022, and you may choose to consult with a tax advisor.

- The Energy Efficient Commercial Buildings tax deduction (Section 179D) allows building owners to get a tax deduction — which reduces taxable income rather than the taxes owed directly — for installing approved efficient systems for interior lighting, HVAC and hot water systems, or building envelopes.

-

Commercial Clean Vehicles

Commercial Clean Vehicles – Tax Credit up to $40,000 for a large vehicle (45W)

- Up to 30% tax credit on the incremental cost of electric commercial vehicles placed in service before 2033.

- There is a per-vehicle limit of $7,500 for vehicles with a gross weight of fewer than 14,000 pounds (e.g. delivery vans or other fleet vehicles) and a $40,000 limit for vehicles at or above that weight (e.g. garbage trucks, buses).

- No manufacturing requirements.

- See the IRS website for more information.

The information on this page is not intended as legal or tax advice for specific individuals or organizations or actual determination of eligibility for tax credits and/or deductions of any particular project or activity. Please visit the IRS website for more information on tax credits and deductions under the Inflation Reduction Act of 2022, and you may choose to consult with a tax advisor.

-

Clean Electricity Investment Tax Credit

Clean Electricity Investment Tax Credit – up to 70% of installation costs (48)

- The Investment Tax Credit (Section 48) provides a 30% uncapped tax credit, with certain requirements, for the cost of installing solar, small wind, geothermal, energy storage, and more.

- Can be used for utility-scale projects or building-scale projects (like rooftop solar on commercial buildings)

- Utility-scale projects must meet certain labor requirements to claim the full credit.

- Additional bonuses for projects that use domestic content (+10%) and projects in legacy energy communities (+10%) or in low-income communities (+10% or +20%, limited availability and must apply for an allocation) potentially increasing the value of the credit to 70% of the eligible installation costs.

- These credits are applicable to projects that start construction before 2025.

- After 2025, new clean electricity investment tax credits (48E) will be available through at least 2033, with a structure similar to the credits described above, pending guidance from the IRS.

- Can be used for utility-scale projects or building-scale projects (like rooftop solar on commercial buildings)

The information on this page is not intended as legal or tax advice for specific individuals or organizations or actual determination of eligibility for tax credits and/or deductions of any particular project or activity. Please visit the IRS website for more information on tax credits and deductions under the Inflation Reduction Act of 2022, and you may choose to consult with a tax advisor.

- The Investment Tax Credit (Section 48) provides a 30% uncapped tax credit, with certain requirements, for the cost of installing solar, small wind, geothermal, energy storage, and more.

-

Clean Energy Production Tax Credit

Clean Energy Production Tax Credit – up to $33 per MWh (45)

- The Production Tax Credit (Section 45) is available as a corporate tax credit for facilities generating renewable energy, beginning construction before January 1, 2025.

- Eligible technologies include geothermal electric, solar, wind, hydroelectric, offshore wind, and more.

- For projects < 1MW or meeting labor requirements, the credit is $27.50/MW, inflation-adjusted.

- The base credit of $5.50/MW is multiplied by five for projects meeting prevailing wage and registered apprenticeship requirements.

- Credit is increased by 10% if the project meets certain domestic content requirements for steel, iron, and manufactured products.

- Credit is increased by 10% if located in an energy community.

- These credits are applicable to projects that start construction before 2025.

- After 2025, new clean electricity production tax credits (45Y) will be available through at least 2033, with a structure similar to the credits described above, pending guidance from the IRS.

The information on this page is not intended as legal or tax advice for specific individuals or organizations or actual determination of eligibility for tax credits and/or deductions of any particular project or activity. Please visit the IRS website for more information on tax credits and deductions under the Inflation Reduction Act of 2022, and you may choose to consult with a tax advisor.

-

Rural Energy for America Program (REAP)

Rural Energy for America Program (REAP) – Loans and grants for renewable energy and energy efficiency

- The REAP program provides guaranteed loan financing and grant funding to agricultural producers and rural small businesses.

- Funds may be used for solar, wind, hydro, geothermal, or biomass renewable energy systems, or for energy efficiency improvements including HVAC, insulation, lighting, and replacing energy-inefficient equipment including sprinkler and irrigation systems.

- Loan guarantees on loans up to 75% of the total eligible project costs, or grants for up to 50% of project costs.8Grants and loan guarantees can also be combined to provide funding up to 75% of total eligible project costs.

- Grants can range from $2,500 to $1 million for Renewable Energy Systems, or from $1,500 to $500,000 for Energy Efficiency grants.

The information on this page is not intended as legal or tax advice for specific individuals or organizations or actual determination of eligibility for tax credits and/or deductions of any particular project or activity. Please visit the IRS website for more information on tax credits and deductions under the Inflation Reduction Act of 2022, and you may choose to consult with a tax advisor.

-

Electric Vehicle Charging

EV Charging – Tax Credit of up to $100,000 per charging facility (30C)

- The EV Charging Tax Credit (Section 30C) provides a 30% tax credit (up to $100,000 per charging facility) for electric vehicle charging installed in low-income or rural census tracts.

- Find out if your community qualifies by using the U.S. Department of Energy’s 30C Tax Credit Eligibility Locator.

- Available through 2032.

The information on this page is not intended as legal or tax advice for specific individuals or organizations or actual determination of eligibility for tax credits and/or deductions of any particular project or activity. Please visit the IRS website for more information on tax credits and deductions under the Inflation Reduction Act of 2022, and you may choose to consult with a tax advisor.

-

Advanced Energy Projects

Advanced Energy Projects – Capped Tax Credit (48C)

- Section 48C provides $10 billion in tax credits to cover up to 30% of the costs for investments in advanced energy projects that:

- (1) re-equips, expands, or establishes an industrial or manufacturing facility for the production or recycling of a range of clean energy equipment and vehicles;

- (2) re-equips an industrial or manufacturing facility with equipment designed to reduce greenhouse gas emissions by at least 20 percent; or

- (3) re-equips, expands, or establishes an industrial facility for the processing, refining, or recycling of critical materials.

- Unlike most of the other tax credits, 48C is capped and must be applied for on a competitive basis.

- At least $4 billion must be allocated to projects located in Energy Communities Census Tracts.

- Further guidance is available here and more information is here. Learn more about the first of two rounds of awards here.

The information on this page is not intended as legal or tax advice for specific individuals or organizations or actual determination of eligibility for tax credits and/or deductions of any particular project or activity. Please visit the IRS website for more information on tax credits and deductions under the Inflation Reduction Act of 2022, and you may choose to consult with a tax advisor.

- Section 48C provides $10 billion in tax credits to cover up to 30% of the costs for investments in advanced energy projects that:

-

Clean Energy Financing – Loans and Loan Guarantees

Clean Energy Financing – Loans and Loan Guarantees

- The Department of Energy’s Loan Programs Office (LPO) runs the Innovative Energy and Innovative Supply Chain (Section 1703) loan program, which is funded at $3.6 billion through FY2026, with authority to guarantee up to $40 billion of loans.

- Loan guarantees for projects that avoid, reduce, or sequester air pollutants or anthropogenic greenhouse gas emissions.

- While LPO generally only works with higher loan amounts, they can support a variety of project types:

- LPO can finance “innovative” projects like virtual power plants.

- If state entities supplement LPO funding, the “innovative” requirement can be waived, allowing LPO to help fund standard clean energy deployment.

- LPO can provide subsidized loans for onshoring of domestic manufacturing facilities.

The information on this page is not intended as legal or tax advice for specific individuals or organizations or actual determination of eligibility for tax credits and/or deductions of any particular project or activity. Please visit the IRS website for more information on tax credits and deductions under the Inflation Reduction Act of 2022, and you may choose to consult with a tax advisor.

-

Replace Energy Infrastructure — Loan Guarantees

Replace Energy Infrastructure — Loan Guarantees

- LPO’s Energy Infrastructure Reinvestment program (Section 1706) creates a loan guarantee program for projects that involve modifying or replacing inactive energy infrastructure to reduce toxic and carbon pollution.

- The clean energy plan provided this program with $5 billion (through FY 2026) for the Department of Energy to support loan guarantees of up to $250 billion. The loan amount cannot exceed 80% of eligible project costs.

- Financing for projects that retool, repower, repurpose, or replace energy infrastructure that has ceased operations or enable operating energy infrastructure to avoid, reduce, utilize, or sequester air pollutants or carbon pollution.

- Available for commitment through September 30, 2026.

- See more information on the LPO website here.

- Sign-up for a no-cost, pre-application consultation here.